ohio sales tax exemption form example

Corporate Tax Tools and Services to Help Businesses Accelerate Tax Transformation. Some examples of types of purchases that qualify for the Ohio sales tax exemption for manufacturing include the following.

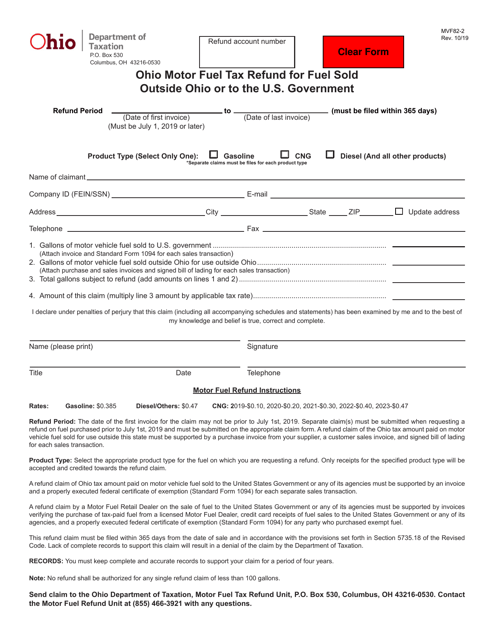

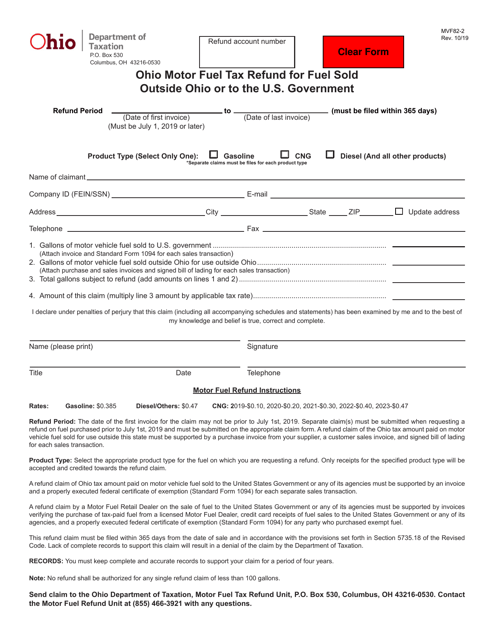

Form Mvf82 2 Download Fillable Pdf Or Fill Online Ohio Motor Fuel Tax Refund For Fuel Sold Outside Ohio Or To The U S Government Ohio Templateroller

In Ohio sales tax exemption is available to churches organizations exempt from federal taxation under IRC Sec.

. A typed drawn or uploaded signature. Per Ohio Administrative Code 5703-9-14 F1 a taxpayer that operates as both a manufacturer and a. Follow the step-by-step instructions below to eSign your ohio tax exempt form pdf.

This page discusses exemptions that may apply to motor vehicle transfers. While the Ohio sales tax of 575 applies to most transactions there are certain items that may be exempt from taxation. 501c3 and nonprofit organizations operated.

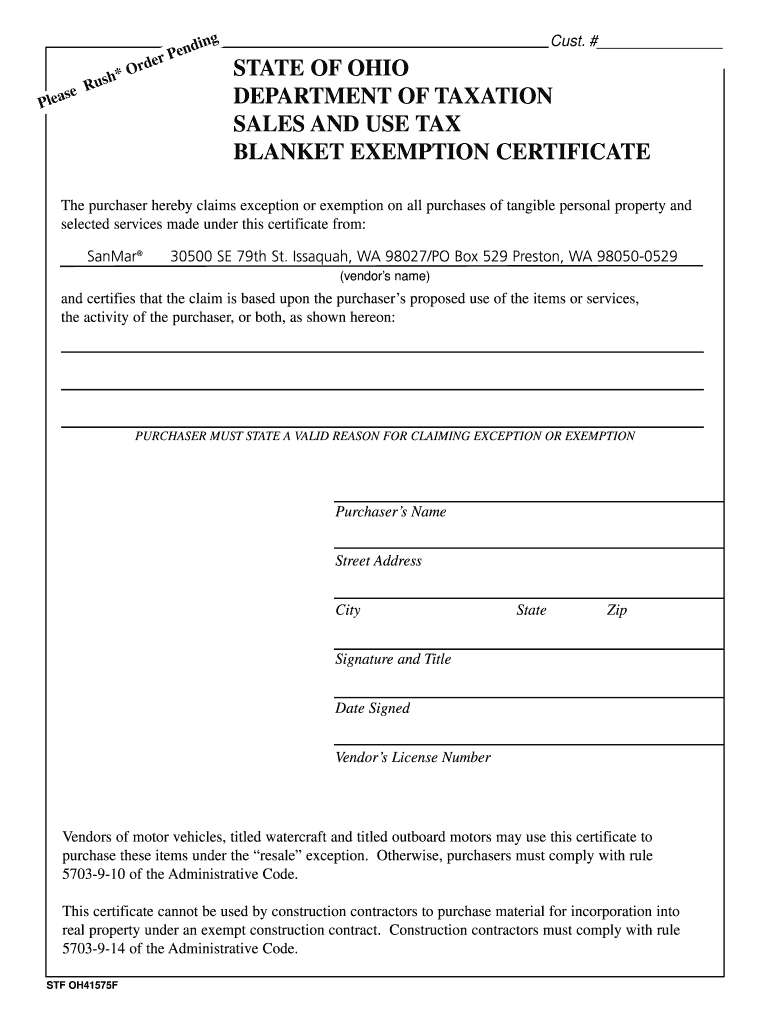

How to fill out the ohio sales and use tax exemption certificate. An exemption is a statutory reason that a retail sale is not subject to sales or use tax. Pick the template you want from the library of legal form samples.

Production machinery and equipment that act upon the product Machinery and equipment used to treat parts or materials in preparation for the manufacturing operation. Decide on what kind of eSignature to create. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Farming is one of the exceptions. 1 PDF editor e-sign platform data collection form builder solution in a single app. FAQs ohio tax exempt form example.

Direct Farming Farming Motor vehicles used primarily in the production of agricultural products for sale may be exempt under R. Step 3 Describe the reason for claiming the sales tax exemption. Select the document you want to sign and click Upload.

Knowing which items are exempt from sales tax can save you money when shopping in Ohio. Here is a list of the most common customer questions. Select the document you want to sign and click upload.

How to use sales tax exemption certificates in ohio. OH Off-Highway Motorcycle An exemption applies to off-highway motorcycles purchased prior to July 1 1999 which is when the requirement to title these vehicles came into effect. This form is updated annually and includes the most recent changes to the tax code.

08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities. Items that Qualify for Exemption Consumables Example. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Printing and scanning is no longer the best way to manage documents. Execute Tax Exempt Form Ohio within several moments by following the recommendations listed below. Ad Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges.

What is Ohio State tax. You can use the Blanket Exemption Certificate to make further purchases from the same seller without having to give a newly completed form every time. Ad Download Or Email STEC CO More Fillable Forms Register and Subscribe Now.

This page discusses various sales tax exemptions in Ohio. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Ad New State Sales Tax Registration.

Since the majority of exceptions or. If you cant find an answer to your question please dont hesitate to reach out to us. How to fill out the Ohio Sales and Use Tax Exemption Certificate.

Handy tips for filling out Ohio sales tax exemption form online. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Currently Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax.

January 1 through June 30 return is due on July 23rd and July 1 through December 31 return is due on January 23rd. Step 2 Enter the vendors name. Ohio sales tax exemption form example.

Sales Tax Exemption Form Ohio information registration support. Send the completed form to the seller and keep a copy for your records. A few examples of exemptions for motor vehicles.

The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. Table of Contents The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Sales tax exemption form example online e-sign them and quickly share them without.

Download 1040ez free printable form 2017 sample from ohio tax exempt form 2019 with resolution. Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

There are three variants. For other Ohio sales tax exemption certificates go here. Sales and Use.

Create your eSignature and click Ok. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. Sales Tax Exemptions in Ohio.

Prior to this sales tax was paid directly to the Treasurer of State not the local Clerk of Courts title office. It is a statutory exemption from sales tax laid out in 573902 B42g for specific items used in a. Our tax preparers will ensure that your tax returns are complete accurate and on time.

Choose the Get form button to open the document and begin editing. Sales tax exemption in the state applies to certain types of. However this does not make all purchases by farmers exempt.

Submit all of the requested fields these are marked in yellow.

Ohio Tax Exempt Form Fill And Sign Printable Template Online Us Legal Forms

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

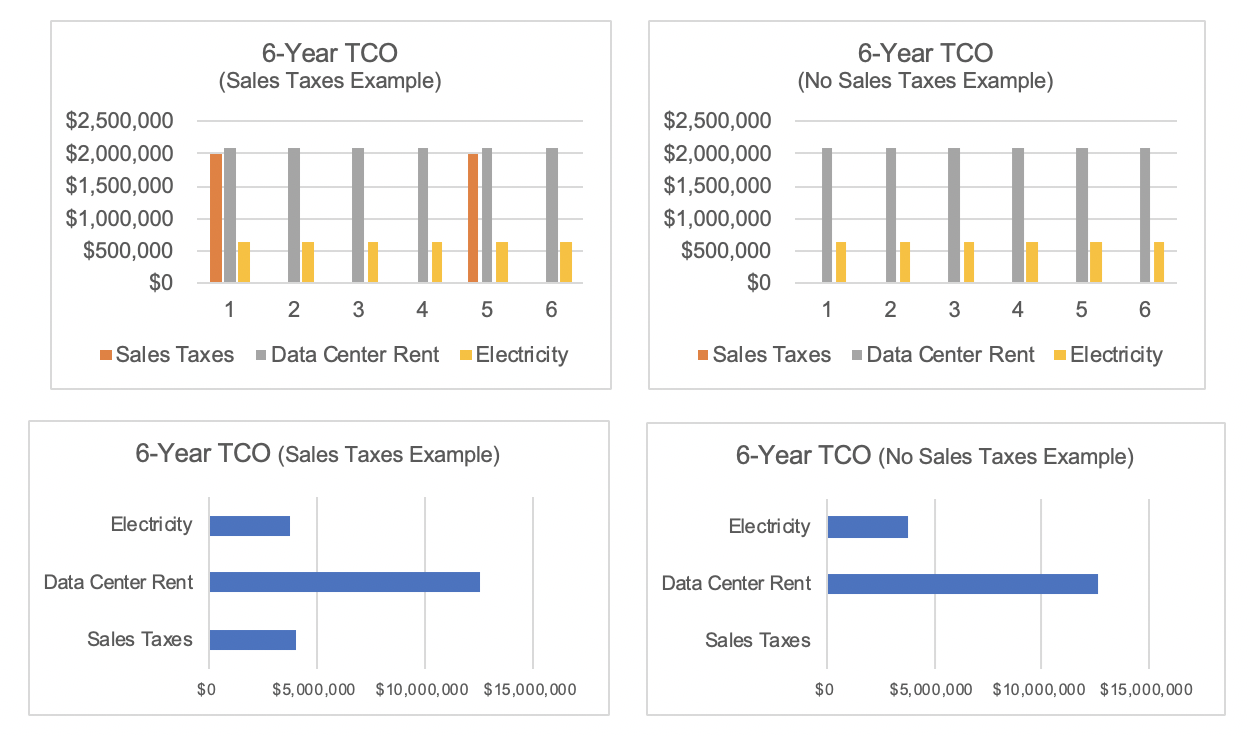

Data Center Resources Enterprise Colocation H5 Data Centers

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

Set Up Sales Tax In Quickbooks Desktop

How Do State And Local Sales Taxes Work Tax Policy Center

What Qualifies You For Sales Tax Exemptions

How Selling Through Multiple Channels Can Impact Sales Tax Obligations

Sales And Use Tax Digital Products Department Of Taxation

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

How Do State And Local Sales Taxes Work Tax Policy Center

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

Should You Move To A State With No Income Tax Forbes Advisor